The palliative care field is in the midst of evolution, with reimbursement and workforce dynamics being the dominant forces influencing sustainable growth in the space.

Palliative providers are focusing their greatest efforts on navigating choppy, and often lagging, reimbursement streams to meet increased demand for serious illness care. These streams flow directly into their ability to recruit and retain sufficient volumes of interdisciplinary staff trained in providing specialized palliative care.

To a date, the nation’s health care reimbursement system lacks a federally established palliative care benefit. This has left palliative care providers with less than reliable payment avenues, a primary issue when it comes to sustainable and effective delivery, according to Brynn Bowman, CEO of the Center to Advance Palliative Care (CAPC).

CAPC provides training and technical assistance to serious illness health care professionals and organizations.

“Without a palliative care benefit, these are non-revenue services that providers worry about sustaining not only for patients, but also their interdisciplinary teams,” Bowman told Hospice News. “That’s a main issue, … how to have even the minimum viable amount of financial support needed to have a palliative care workforce that adequately supports patients. Payment and workforce are certainly the challenges and headwinds tied together that we hear most about [from providers].”

Those aren’t the only two dynamics shaping palliative care, however.

A more “passive headwind” from the lack of standardized reimbursement is that no certification or licensing requirements exist for palliative care staff at the federal level, Bowman said.

This leaves quality measures in a place of “volatility” and workforce pipelines strained, she added. It can be difficult to find qualified, experienced palliative staff members that understand the full scope of interdisciplinary care involved, Bowman stated.

Payment, workforce pressures

Reimbursement paths for palliative care can primarily be found in Medicare Part B for physician services, and also through supplemental benefits included in Medicare Advantage (MA). Other reimbursement options exist in payment arrangements with Accountable Care Organizations (ACOs) and Managed Services Organizations (MSOs).

Palliative care is also part of the hospice component of the MA value-based insurance design (VBID) demonstration.

Hospices have historically made up the majority of palliative care providers in the home-based payment realm. But the mix of palliative providers and care settings may be shifting alongside evolving reimbursement models, as payers increasingly recognize the value of these services, according to Alivia Care Inc. President and CEO Susan Ponder-Stansel.

“What we’re really talking about is palliative care as a core component of serious illness care, which is now being delivered in a variety of ways by multiple types of providers,” Ponder-Stansel told Hospice News in an email. “It is an essential element in any kind of value-based care, which is why as more providers are moving to value services that use a palliative approach to care are evolving or being brought to market. The [traditional] fee-for service consultative approach has limitations, and I don’t see those improving. Instead, I think there are all kinds of flavors of palliative care being developed as a way to care for patients who are high-cost, high-need under a variety of value-based payment models.”

In addition to hospice and palliative care, the Florida-based Alivia offers advance care planning, care coordination, home care and PACE services in its home state and in Georgia.

Hospices made up more than half of the palliative care providers within Medicare Advantage reimbursement during 2020 and 2021, according to a recent CAPC report.

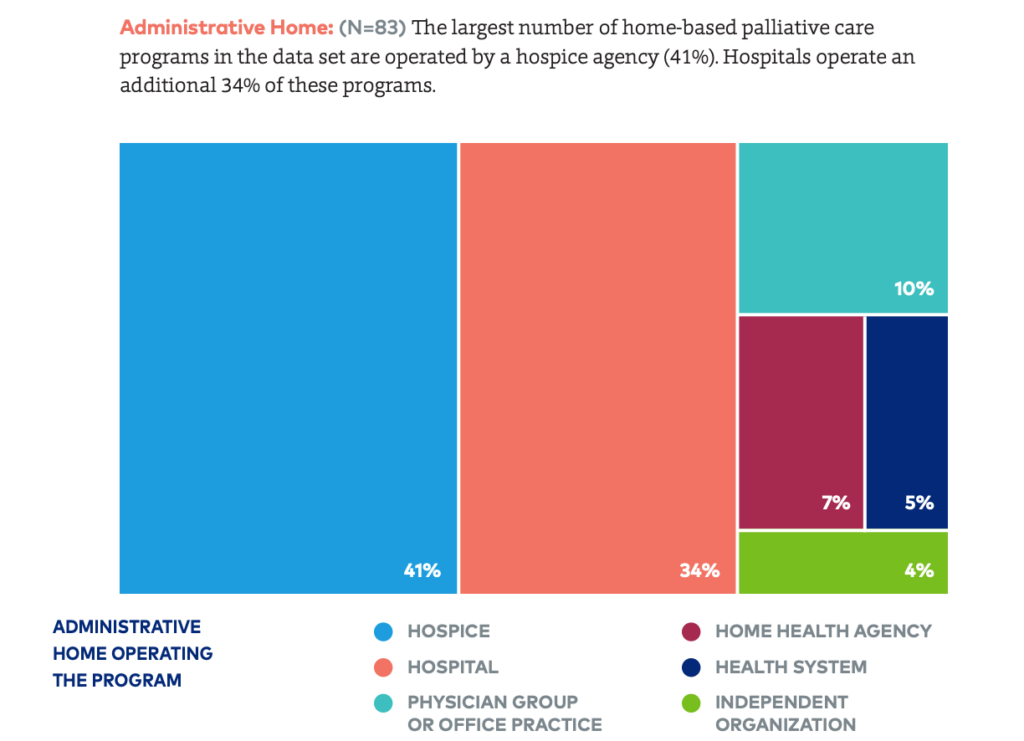

Most often, these were community-based palliative services, with hospices representing 41% of these providers, the CAPC data showed. Hospitals fell second in line, with hospital-based systems operating an estimated 34% of home-based palliative programs nationwide.

The remaining bulk of palliative care Medicare programs are fielded by physician groups and home health agencies, at 10% and 7%, respectively, Bowman indicated. A small handful are primary or independent palliative care providers offering care in the home primary, she added.

Home-Based Palliative Care” report. (Courtesy of CAPC)

Turning headwinds to tailwinds

Thriving in palliative care delivery will take greater financial resources in standardized reimbursement structures, according to Bowman.

Cost-savings data will be an important piece of establishing a dedicated palliative payment system, she said.

“What we see palliative care providers doing most in navigating payment forces is illustrating the financial impact of their services,” she said. “The financial argument hinges on the added layers of support that palliative care brings that avoid costly ‘crisis care’ in emergency settings. Reduced lengths of [hospital] stays and readmissions tied to a palliative program can show why it needs to be well-staffed in addition to demonstrating the value of the program to payers and referrals. To make this goal a reality and harness palliative care’s power, providers need the budget.”

For now, it’s up to palliative providers to help shape the payment mold, Ponder-Stansel stated. As far as headwinds for the traditional approach to palliative care, providers shouldn’t anticipate regulators to develop a stand-alone or defined palliative care benefit anytime soon, she said.

“Instead, [payers] intend to integrate into the new value-based models that are being adopted in the market,” Ponder-Stansel said. “I see the increasing move to value as a way for us to bring the practice and principles of palliative care more into the mainstream, and to receive payment that actually not only covers the cost of services, but [also] provides income — if we do it well and bring good patient outcomes. I think the recognition of the value of palliative care has lots of tailwinds.”

I think the recognition of the value of palliative care has lots of tailwinds.

— Susan Ponder-Stansel, president and CEO, Alivia Care Inc.