Home health care providers are increasingly recognizing the clinical value of palliative care, despite its tricky payer landscape and relatively low margins.

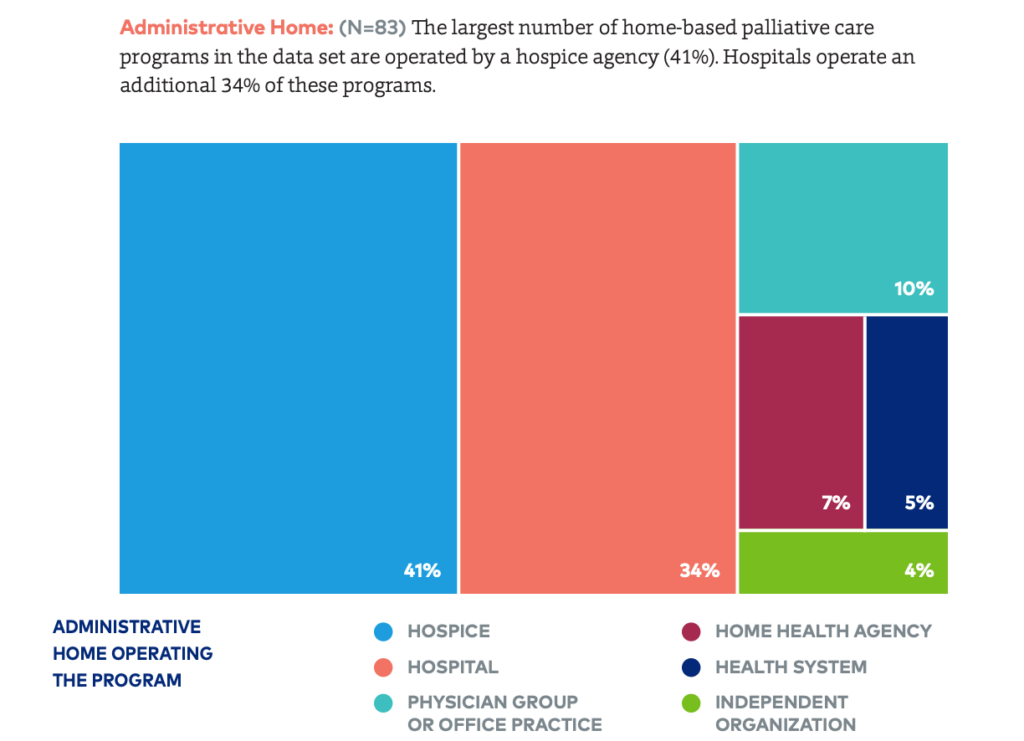

Hospices have a much larger presence in the space, but more home health agencies are showing an interest — including companies that provide both of those services. Close to half of community-based palliative care programs are operated by hospice agencies and 7% are operated by home health operators, according to 2019 data from the Center to Advance Palliative Care and Palliative Care Quality Collaborative data.

Palliative care a medical subspecialty as well as a unique set of care models for seriously ill patients, according to Rory Farrand, vice president of palliative and advanced care at the National Hospice and Palliative Care Organization (NHPCO).

“The goal of palliative care is to improve the quality of life for people living with serious illness, whether that illness is going to be life-limiting, terminal, or just something that’s really serious,” she told Palliative Care News. “Our objective is to manage pain, symptoms and provide other types of support, depending on a person’s individual situation or their specific needs.”

The Washington, D.C.-based NHPCO is the largest membership organization for hospice and palliative care providers.

Oftentimes, palliative care is conflated with hospice care services.

“The biggest difference between palliative care and hospice is that [the former] can be provided at the same time someone is receiving curative care or disease-modifying therapies like treatments for cancer or dialysis,” Farrand said.

However, reimbursement models for palliative care are not as clear cut as those for home health or hospice.

“Medicare does not cover palliative care as a benefit, so a lot of organizations really struggle with how palliative care is paid for,” Farrand said.

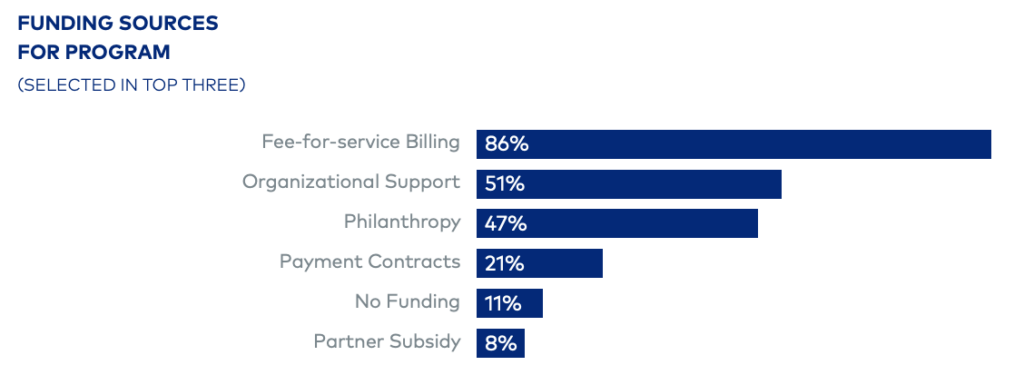

Most commonly, palliative care is covered under fee-for-service arrangements, for example, under Medicare Part B, through Medicare Advantage and in some cases Accountable Care Organization contracts or via Medicaid in some states.

Along these lines, nTakt CEO Mark Hendrix pointed out that palliative care isn’t exactly a high-margin business model.

“They are not what I would consider highly profitable, but you can build a palliative care program that is financially sustainable,” he told Palliative Care News.

nTakt helps organizations launch palliative care programs. The company assists organizations in building financially viable programs with the right technology in place.

When seeking reimbursement through value-based programs, providers that have an established track record of positive health outcomes are the best-positioned.

“Once you’ve proven yourself in the marketplace, and you’ve proven that you can reduce cost of care of patients with your palliative program, you can then go out and prove your value to insurance companies and other payers,” Hendrix said. “Then you could step away from the fee-for-service model and go more with a negotiated alternative rate. At that point in time, it can be much more financially viable.”

Palliative care is a differentiator for Alivia Care

One company that has made palliative care work is Alivia Care Inc.

Alivia Care is a nonprofit provider of home health, hospice and palliative care services. The company operates across 32 counties in North Florida and Southeast Georgia.

Alivia Care provides palliative care for patients through hospital partnerships. It also provides these services to patients through oncology partnerships.

In general, Alivia Care CEO Susan Ponder-Stansel has seen an increase in the demand for palliative care, even if patients aren’t able to identify these services by name.

“Sometimes patients and families don’t know the term, but we will see someone in our home health side, for instance, who has end-stage renal disease or advanced cancer, and their caregiver will say, ‘She’s tired of going to the hospital, I wish there was something different we could do,’” Ponder-Stansel told Palliative Care News. “People are sometimes looking for an alternative to very aggressive care that doesn’t always improve their situation.”

Palliative care has brought value to Alivia Care’s home health service line by allowing the company to stand out among peers.

“If you’re in a crowded market, having a palliative care specialty program or focused care program can be a differentiator for you and it can give you an opportunity to look for referrals and patients who might come from oncologists, or those treating advanced heart disease or breathing disorders,” Ponder-Stansel said.

At Alivia Care, palliative care is also a big component of its value-based care engagement.

“Palliative care has been shown to be a way to help patients receive the appropriate type of care that will really improve their outcomes, but will not get them into places where they will receive what we call low value care,” Ponder-Stansel said. “Some of that low value care is often very aggressive, can be very painful, can be very wearying and it won’t really change the course of their illness or improve their quality of life or outcomes.”

Ponder-Stansel noted that many Medicare Advantage organizations are eyeing palliative care as a way to manage people with very serious and advanced illnesses.

Ultimately, Ponder-Stansel believes that palliative care is a valuable tool for post-acute care providers to have.

“I don’t think people are making big margins on that particular line of service, but it can be a way to help the other types of services you provide,” she said. “If you have provider bandwidth, you have resources in your home health segment, or among your medical group, it is a way to utilize that capacity very effectively.”