The COVID-19 pandemic pummeled Brookdale Senior Living’s (NYSE: BKD) hospice segment during the third quarter, despite seeing growth earlier in the year.

While patients do not have to be residents of Brookdale’s senior living communities to use their health care services, that is where the company obtains most of its hospice business. With widespread disruption in the senior living industry stemming from pandemic fears, Brookdale’s hospice segment also began to slide. The company received pandemic-related federal aid funds to help balance out some of these reductions.

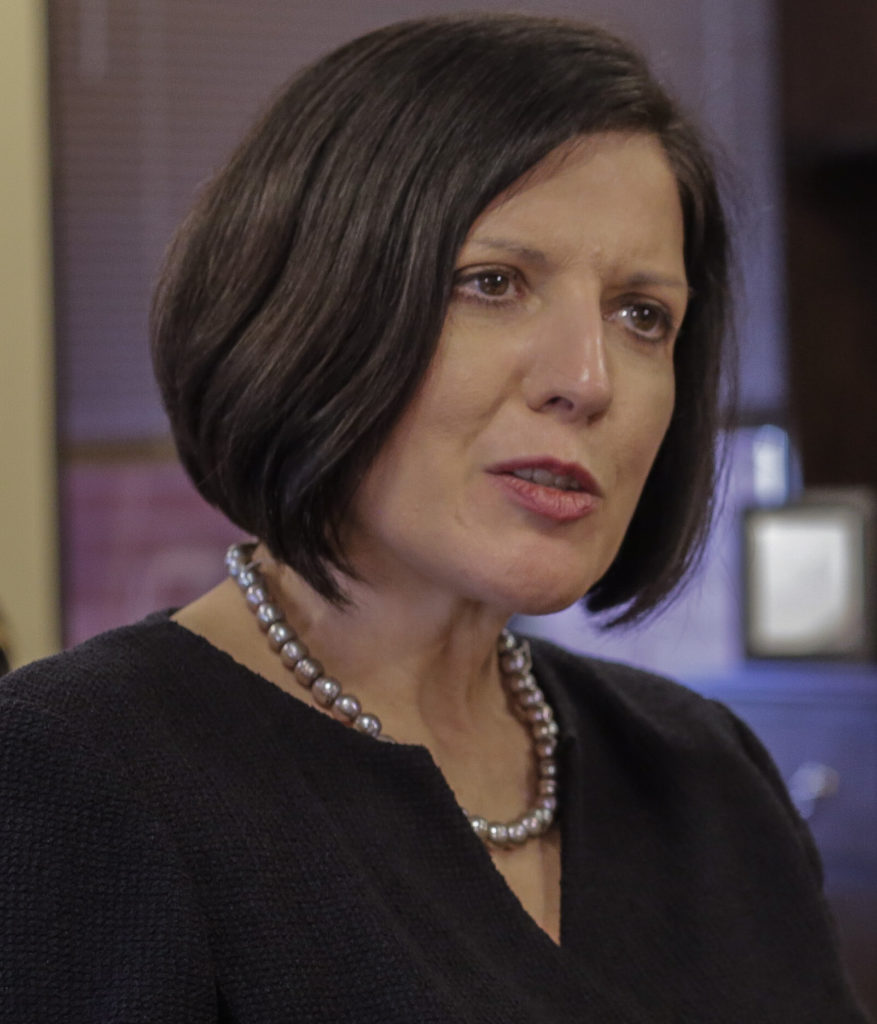

“With a large portion of our services within our communities, lower senior housing occupancy is impacting this business,” President and CEO Lucinda Baier said during an earnings conference call. “We are pleased to recognize approximately $6 million of phase one grants as other operating income in our health care services segment during the third quarter.”

The company saw a 9% drop in hospice revenues in the third quarter of 2020, compared to the prior year’s quarter. Q3 hospice revenues fell to almost $23 million from $25.2 million in the same period in 2019. Revenues were also down slightly compared to the first and second quarters of this year.

Brookdale’s hospice line was on a more positive trajectory through January and February, but the hits started coming as the pandemic exploded in March. Brookdale in 2019 committed to growing its hospice operations primarily through de novo activity and same-store admissions. The company opened hospices in Detroit, Portland, Ore., and Sacramento, Calif last year.

With seniors particularly vulnerable to COVID-19, the pandemic has rocked the senior housing and assisted living industries with many facilities seeing outbreaks or reduced resident volume. Brookdale has a high concentration of facilities in virus hotspots like Florida and Texas. All told, the pandemic cost Brookdale $71 million in Q3, even as the company contended with wildfires and hurricanes in some of its markets.

“The virus is unpredictable. We expect to see a sequential decline in occupancy, but we do expect that to moderate again in the fourth quarter,” said Executive Vice President and CFO Steven Swain. “It’s important to keep in mind some of the key drivers for occupancy and recovery; 95% of our communities are open and accepting residents. The low infection rates that we currently have in our communities is certainly a plus.”

Overall throughout the industry, senior housing occupancy nationwide fell 2.6% during the third quarter of 2020, to 82.1%, down from 84.7%, continuing a downward trend that began in tandem with the outbreak, according to the National Investment Center for Seniors Housing & Care (NIC).

Despite the obstacles, Brookdale remains optimistic about the prospects of its fourth quarter and early 2021 performance. They expect demographic tailwinds from the aging population to boost demand beyond COVID, particularly after a vaccine becomes available, and they have stepped up marketing efforts.

While suffering severe disruption early in the pandemic, the company’s home health business is starting to normalize. Likewise, the rate of decline in his senior housing occupancy has begun to slow as of July through September. Recovery in these areas could help support hospice referrals going forward.

Brookdale did see a strong boost earlier this year through its restructuring with Ventas (NYSE: VTR), a Chicago-based real estate investment trust. The two companies initiated a new master lease agreement in July through which Brookdale will receive as much as $500 million in rent reduction during the next five years. Ventas through the deal acquires a potential equity stake in Brookdale.

The company has implemented a range of cost control measures to stave off further declines and maintains a strong liquidity position with nearly $500 million of cash and marketable securities.

“During the third quarter, we built upon our prior successful efforts to effectively navigate through the pandemic with operational improvements and transactions to strengthen our financial position,” Baier said. “We’ve been an agile, learning organization and continue our efforts to innovate for our residents’ enjoyment and to welcome more seniors into our communities.”